Click to Pay: The Solution that Simplifies and Enhances Online Commerce Security

E-commerce in Latin America is continuously growing, but along with this expansion come challenges such as high cart abandonment rates, low approval rates, and concerns about fraud. To address these issues, major brands, through EMVCo (EMV Co), developed Click to Pay to simplify the checkout process, making it more convenient and secure globally. The solution … Continued

E-commerce in Latin America is continuously growing, but along with this expansion come challenges such as high cart abandonment rates, low approval rates, and concerns about fraud. To address these issues, major brands, through EMVCo (EMV Co), developed Click to Pay to simplify the checkout process, making it more convenient and secure globally.

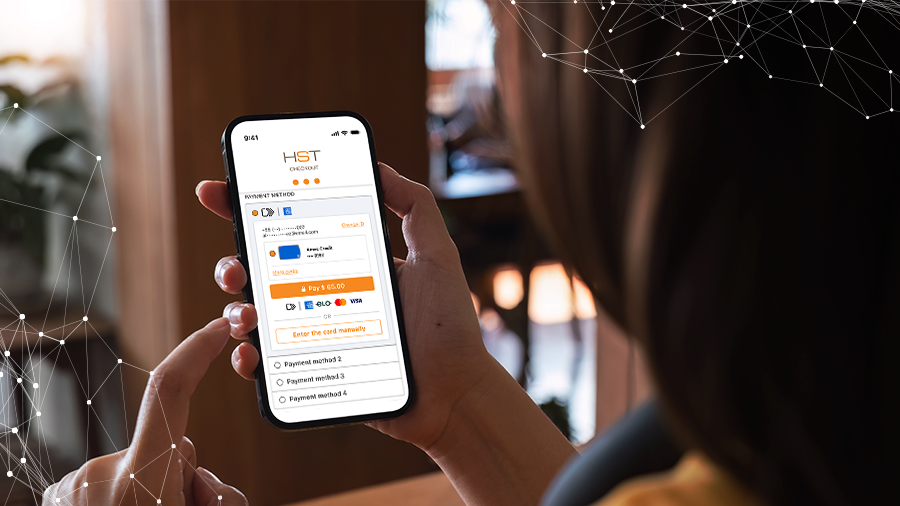

The solution developed by HST aims to serve Issuers, E-commerce businesses, and Acquirers in implementing online payment technology that ensures a fast, simple, and secure experience for their customers, in line with the strict global EMV standards.

What is Click to Pay?

Click to Pay is the commercial name for the EMV Secure Remote Commerce (SRC) standard, developed by the major brands (Visa, Mastercard, and American Express). This solution provides an electronic payment experience that is as secure and convenient as a physical purchase, utilizing advanced technologies such as tokenization and 3D-Secure.

With Click to Pay, consumers can complete their online purchases with just one click, without the need to repeatedly enter card details or fill out long forms. All of this is integrated and compatible with mobile devices and web browsers.

“With the Click to Pay solution, we were able to reduce checkout time, eliminate friction, and consequently increase sales, as the payment process becomes faster with fewer clicks, while also ensuring more security and efficiency for the entire online payment ecosystem.” – Marcelo Rodrigues, Director of HST

How Does Click to Pay Work? The Process is Simple and Efficient

- Registration: The consumer registers their credit cards on the Click to Pay platform.

- Checkout: At the time of purchase, the consumer selects Click to Pay as the payment method.

- Authentication: They are redirected to a secure page where they enter their credentials (such as email and password) and select the card to be used.

- Confirmation: After confirming the information, the consumer returns to the merchant’s site to complete the purchase.

- Processing: The payment is securely processed, and transaction details are shared with the merchant.

This simplified journey reduces checkout friction, increases conversion rates, and offers a smooth and secure shopping experience.

Benefits of Click to Pay

Click to Pay offers several advantages for consumers, merchants, and financial institutions:

Consumers:

- Security: Payment information is encrypted and stored on secure servers, reducing the risk of fraud.

- Convenience: Quick and simple purchases, without the need to repeatedly enter data.

- Compatibility: Works across various devices, such as computers, smartphones, and tablets.

Merchants and Acquirers:

- Reduced Cart Abandonment: A smooth checkout experience that decreases abandonment rates and increases conversions.

- Fraud Protection: The use of tokenization and 3D-Secure ensures secure transactions.

- Simplified Integration: A single integration point with brand’ SRC systems, eliminating the need for multiple certifications.

Card Issuers:

- Higher Transaction Approval: Technologies like tokenization and 3D-Secure increase approval rates.

- Credential Management: Registration and management of credentials through tokens, supporting both new and existing accounts.

“With a simplified integration that takes just two months, the Click to Pay solution becomes an essential tool for optimizing e-commerce payment operations. Ensuring a smoother checkout experience that meets the highest international security standards.” – Victor Nascimento, Head of Products at HST

HST Click to Pay Solution Differentiators

HST offers a fast and secure implementation of Click to Pay, with differentiators that set the solution apart in the market:

- Fast Integration: With HST, your solution will be up and running in just 2 months, while direct implementation with brands can take up to 12 months.

- Guaranteed Certification: Connection certified by the major brands, ensuring compliance with security standards such as PCI-DSS.

- SaaS Solution: Cloud platform, with integration via APIs or Web SDK, compatible with various platforms and brands.

- Agnostic and Local Provider: Direct integration with each brand, adhering to the latest market versions and specifications, developed locally in Brazil.

- Differentiated Support: A dedicated support team for all of Latin America, providing assistance in the local language to facilitate operations.

- Cost Reduction: Eliminates the need for multiple certifications, saving both time and resources.

Who is Click to Pay For?

- Card Issuers: Provide a frictionless payment experience for their customers with security and convenience.

- Acquirers: Simplify the checkout process for their merchants, increasing conversion rates.

- Merchants: Offer a smooth and secure online shopping experience, reducing cart abandonment.

HST – More Security for Electronic Transactions

HST specializes in digital payment solutions and is ready to help your institution implement Click to Pay quickly and efficiently. With our solution, you ensure a secure, fast, and convenient online shopping experience, aligned with the needs of today’s market.

Want to Know More? If you want to simplify the online payment process, increase transaction security, and improve your customer experience. Click to Pay is the ideal solution.

Contact HST’s team to learn more!