Want to learn more about tokenization?

Sign up to download our tokenization e-book and sales sheets.

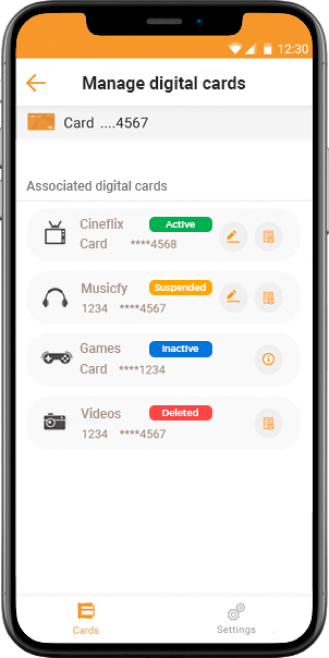

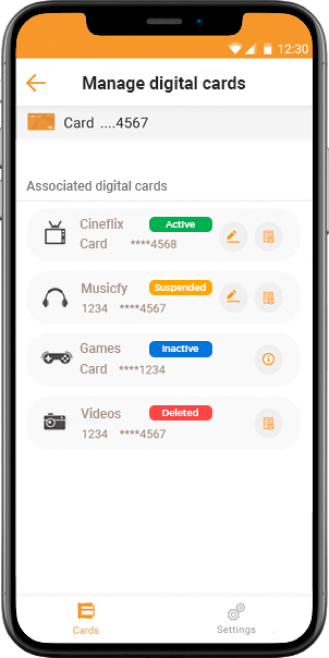

The Issuer SDK can be easily integrated into the issuer's mobile app, allowing cardholders to manage token lifecycle for each card, including cancel, enable, deactivate and check payment history. The solution also allows the issuer and cardholder to monitor transactions for better fraud management.

Support for iOS and Android

Support for iOS and Android

Allows a global view where tokens can be pushed to

Allows a global view where tokens can be pushed to

Allows the user to control and restrict expenses

Allows the user to control and restrict expenses

Sign up to download our tokenization e-book and sales sheets.